Business Process Optimization

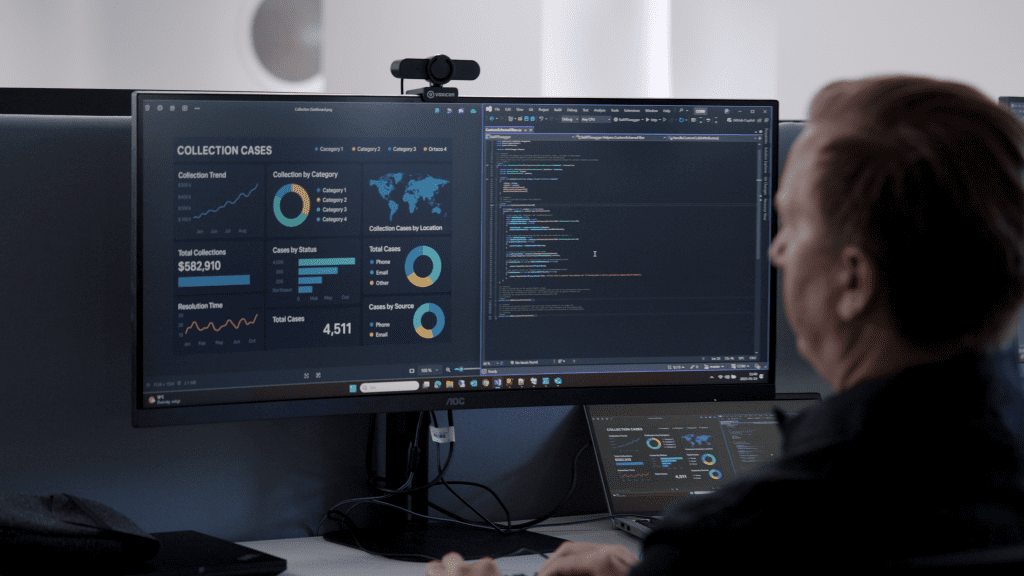

Unleashing Efficiency and Excellence

We help businesses streamline operations, cut costs, and boost efficiency.

With years of experience, we identify and fix bottlenecks, eliminate redundancies, and improve workflows.

By combining smart strategies with the latest tech, like automation and AI, we free up time and resources so your team can focus on what matters most.

Business Process Optimization isn’t just a trend—it’s a smart and structured way to improve how a company works. It focuses on making workflows smoother, cutting out unnecessary steps, and using resources more effectively.

By carefully examining every part of a process—from start to finish—hidden bottlenecks, inefficiencies, and missed opportunities come to light. This full-picture view opens the door to smarter, more efficient ways of working that align with business goals.

Central to the optimization process is the harmonization of technology, people, and strategy. Leveraging technologies, such as automation, artificial intelligence, and data analytics, businesses can achieve unprecedented levels of precision and speed. Repetitive tasks are automated, liberating human capital for higher-value activities, while data-driven insights inform decision-making, steering the company towards informed strategies.

Debt Collection Data Migrations

Smarter, Safer, and Fully Aligned

Migrations often become necessary when a company acquires another or wants to merge multiple systems into a single, more efficient platform. In the debt collection industry, this means moving complex, high-stakes data, such as case history, debt amounts, legal status, payment plans, and recovery milestones, without losing integrity or compliance.

At Caporum Consulting, we specialize in bridging the gap between business strategy and technical execution. With deep expertise in debt collection processes and IT systems, we help companies navigate and carry out even the most complex data migrations.

How We Help

- Strategic Alignment

We ensure that data structures and workflows support your collection strategies, segmentations, and regional regulations. - Comprehensive Planning

From mapping legacy systems to defining data governance and migration logic, we manage the process from end to end. - Seamless Execution

Our team handles data extraction, transformation, and loading (ETL), with rigorous testing and validation to ensure accuracy and continuity. - Enhanced Operations

Once centralized, your data becomes a strategic asset—unlocking automation, analytics, and more informed decision-making. - Regulatory Compliance

We build migrations with privacy and security in mind, ensuring adherence to GDPR, CCPA, and other relevant standards.

We’re experts in the Nova debt collection system and have strong experience with the Microsoft stack, including C#, .NET, and MSSQL.

We’ve handled many successful data migrations, working with systems like Aptic Collect, Tagor, Rival, Inkasso 2000, Microsoft Dynamics CRM, and Predator, among others.

Our broad knowledge of tools and platforms means we can ensure smooth integrations, reliable performance, and well-structured migrations, no matter the complexity.

Whether you’re merging systems after an acquisition or looking to streamline operations, Caporum Consulting provides the insight, precision, and reliability to make your debt collection data migration a success.

IT Consulting for Fintech

Flexible Support with Real Expertise

At Caporum Consulting, we help fintech companies keep their technical operations running smoothly, whether you need hands-on development, project leadership, or solution architecture.

We don’t just understand code, we understand your business. With deep knowledge of the European financial landscape in general and the debt collection industry in particular, we support day-to-day development and help shape systems that are smart, scalable, and compliant.

From building data warehouses and analysis tools to creating import engines, customer portals, and integrating with payment services, APIs, and public authorities—we’ve done it all.

Need extra development capacity in your team? We step in quickly and seamlessly, so your projects keep moving forward without delay.

Technology solutions

Our fintech software isn’t just code; it’s the catalyst for your financial growth. If your business is aiming for frictionless transactions, we have the tools to transform your aspirations into reality.

For financial organizations in general and debt collection agencies in particular we have several interesting software solutions.

Navigating the digital realm is our expertise. Our fintech software streamlines operations, enhances customer engagement, and provides data-driven insights that shape strategic decision-making. We pave the way for your business to thrive in a digital-first world.

In the world of finance, security is paramount. Our fintech software comes fortified with advanced encryption, multi-factor authentication, and robust cybersecurity measures, ensuring that your sensitive financial data remains impenetrable.

Elevate your strategies with insights that matter. Our fintech software seamlessly integrates data analytics, allowing you to dissect trends, forecast market shifts, and make informed decisions that fuel growth.

No matter where you operate, our fintech software is designed to align with your unique market dynamics. We understand that success requires solutions tailored to your region, industry, and audience.

Beyond software, we’re your partners in progress. We provide comprehensive support, continuous updates, and seamless integration to ensure that your fintech journey is marked by success and innovation.

Navigating the intricate landscape of data protection regulations is our expertise. Our fintech software is designed to seamlessly align with GDPR, CCPA, and other industry-specific compliance standards. Rest easy knowing that your operations are both innovative and compliant.

Unlock the potential of your data with our cutting-edge solutions. Transform raw data into actionable insights, make informed decisions, and predict trends that shape your business trajectory.

A few of our software solutions:

Collection Now

Experience a cutting-edge creditor insights platform that empowers your debt collection clients to access real-time updates on the progress of their collections. This platform offers not only comprehensive reports but also facilitates interaction with cases and the creation of cases and payments. Seamlessly integrating with your debt collection system, this cloud-hosted solution redefines efficiency and convenience.

Bailiff Broker

When debts reach the enforcement stage, Bailiff Broker ensures a smooth and compliant connection with national bailiff systems across the Nordics. Our API based solution automates application, case updates, status tracking, error handling and data exchange—reducing manual work.

Elevate your financial business to new heights with our exceptional IT services

We are eager to hear how we can help you

With our expertise, you can unlock the full potential of technology, ensuring that your financial endeavors not only survive but truly thrive in today’s dynamic and competitive landscape.

Feel free to contact us via phone or pay a visit to our office. We welcome the opportunity to engage in a conversation about how we can be of assistance to you.